This article highlights the following points;

1. Trends in Private Fitness Clubs

(Market Size, Number of Fitness Clubs, Membership, Profitability)

We use cookies to optimize and continuously improve our website for individual users. By closing this banner or continuing to view the website, you are agreeing to the use of cookies for this purpose, as detailed in our Privacy Policy.

This article highlights the following points;

1. Trends in Private Fitness Clubs

(Market Size, Number of Fitness Clubs, Membership, Profitability)

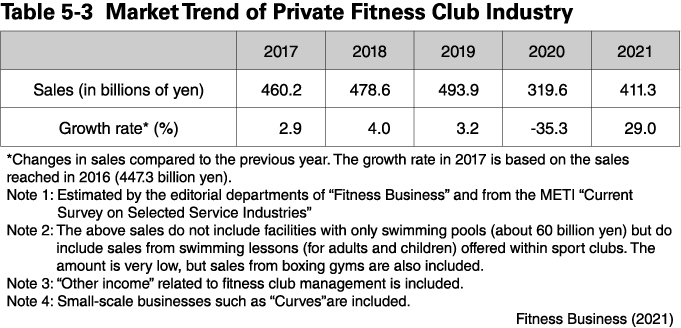

The market size of private fitness clubs in Japan has been growing continuously since 2012, reaching an all-time industry high in 2019 with a market size (sales) of 493.9 billion yen, close to 500 billion yen (Table 5-3). However, under the COVID-19 pandemic in 2020, then Prime Minister’s request to avoid the risk of infection in enclosed spaces and his identification of fitness clubs as high-risk locations for infection forced the fitness industry to close many clubs or shorten their hours of operation due to a half-imposed request for voluntary restraint. As a result, the market size in 2020 declined significantly to 319.6 billion yen, down approximately 35% from the previous year, making business conditions extremely difficult for fitness operators. Eleven of the top 15 fitness industry companies in the financial results for the fiscal year ending March 2021 were in the red, with a total deficit of 60 billion yen. This is actually equivalent to 23% of the total sales of the same 11 companies in the previous year. These operating companies were able to continue their business with financial support from their parent companies and capital alliance partners, but would have gone bankrupt without such support. In fact, others that did not receive support went bankrupt or closed, leading the highest number of fitness business bankruptcies in 2020 in the past ten years.

Although the market size in 2021 was affected somewhat by the Omicron variant (a mutant strain of the COVID-19), it recovered with the convergence and reached 411.3 billion yen, but not as large as the size in 2019. Of note is the change in the composition ratio of the market size. While all fitness club memberships declined significantly in the general business category, which used to account for the majority of sales, the sales composition of 24-hour self-service gyms, personal gyms, swimming schools and online and merchandise sales, which have been increasingly opened in recent years, increased significantly.

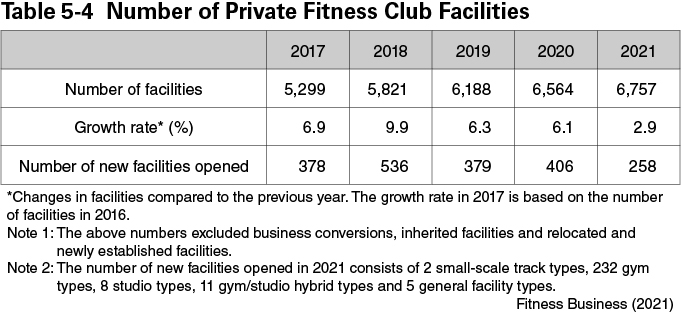

Changes in the number of private fitness club facilities and the number of new private fitness club facilities opened in the last five years are shown in Table 5-4. As of the end of December 2021, the total number of private fitness clubs was 6,757. Before the COVID-19 pandemic, there were 400 to 500 new store openings per year, but in 2021, it dropped to 258. The breakdown by business type showed a large number of gym-type facilities: 2 small circuit-type facilities, 232 gym-type facilities, 8 studio-type facilities, 11 gym/studio-type facilities and 5 general-type facilities. Many of the gym-type facilities are 24-hour self-service gyms and personal training gyms that have been opening in recent years. There was a trend among members in their 20s and 30s who had joined the general business type, to shift to the gym type. Adult-oriented general business types, women-only facilities and boutique-type studios in urban areas were among the business types that had been most affected by the COVID-19 pandemic, and some of these facilities had quickly withdrawn.

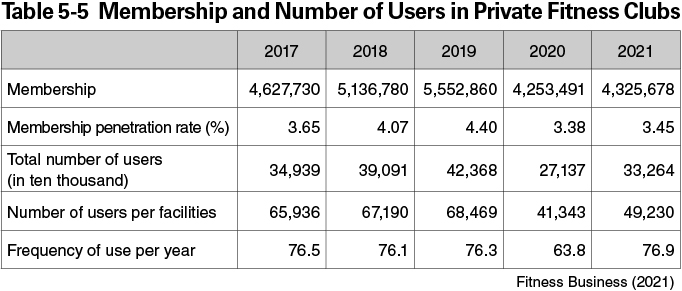

The total number of private fitness club members increased 1.7% from approximately 4.25 million in 2020 to 4.33 million in 2021, but has not recovered, down 22% from the peak year of 2019 (Table 5-5). Although some private fitness clubs were treated as temporarily free and suspended, the progressive withdrawal of members due to a return to fee-based membership is thought to be one of the reasons why the number of the members did not increase significantly. The number of new private fitness club members per month in 2020 and 2021, which was still under the COVID-19 pandemic situation, also remained low and was characterized by no months in which new memberships increased.

The membership penetration rate reached 4.07% in 2018 and 4.4% in 2019, and was expected to grow thereafter, but dropped significantly to 3.38% in 2020. In 2021, it increased slightly, but only to 3.45%. It is assumed that the large increase in the frequency of use per year from 63.8 times in 2020 to 76.9 times in 2021 is affected by these heavy users remaining in the club.

Regarding changes in the revenue of major private fitness clubs, the number of school members has been recovering steadily, but the return of private fitness club members has been slower than expected, and as of December 2022, it remains 20-30% below the peak period in 2019. To compensate for the reduced revenue, each company has been working to reduce costs, raise membership fees, strengthen sales of ancillary services, introduce swimming schools and utilize the designated manager system.